From Bank's to Our's in 4 Years & 9 Months

We were pretty late starters in the Home Owner "race", but started with a healthy hate of debt and loans. So it's not really a surprise that we've spent a lot of effort in getting rid of our mortgage as quickly as possible.

Our mortgage was with ING Direct, and although they have been great (not that they had to do a lot... we did most of it!); but they did provide a product that allowed us to throw all our spare money at fairly easily. When we were investigating mortgage products we had focused on the interest rate, but learned pretty quickly that if you're going to pay the loan off quickly the interest rate matters less. In some ways I would have prefered a product that was easier to manage in exchange for a little more interest... but that's all behind us now!

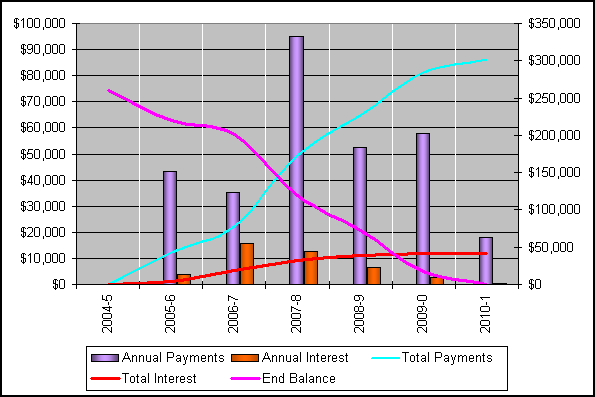

We had significant help from both our parents at the begining of the loan, and kept all our money (savings) in the mortgage account (thereby saving interest, but now have to "save" that back up again). The table below shows the rapid drop of in the amount of interest we were paying to service the loan.

| Year | Interest/Week | Repayments/Week |

|---|---|---|

| 2005/6 | $366 | $833 |

| 2006/7 | $302 | $675 |

| 2007/8 | $247 | $1,831 |

| 2008/9 | $128 | $1,013 |

| 2009/0 | $48 | $1,096 |

| 2010/1 | $21 | $731 |

The 2007/8 year shows the financial help we recieved from our parents.

Over the years that pink line (below) was a great comfort (I also set up a calculated field in our Budget Spreadsheet that told us the likely finish date of the loan)! So the loan cost us about $42,000 (in interest), which means that the house we agreed to pay $260K for actually cost us just over $300K (Not sure what the house is worth today? But if we stay here we're likely to knock it over and build something nice... more about this in the upcoming future section...).

So, to mark the completion of our mortgage, here is a time-lapse of the front of our house over the period of the mortgage: